Composition your budget so that you stay on top of loan payments to guarantee your business winds up stronger and a lot more successful as soon as the stability is paid out off.

Eligibility requirements. If a lender has strict credit rating score specifications that you can’t satisfy, think about other lenders.

Not all loan term lengths can be obtained to all clients. Eligibility relies on creditworthiness and also other aspects. Not all industries are suitable for American Categorical® Business Line of Credit score. Pricing and line of credit choices are based on the general monetary profile of you and your business, which includes history with American Categorical and also other economical institutions, credit rating background, and other aspects. Lines of credit score are subject matter to periodic overview and will transform or be suspended, accompanied with or with out an account closure. Late expenses and return payment service fees might be assessed. Loans are issued by American Specific Nationwide Bank. ¹ Minimum FICO score of a minimum of 660 at time of software. All businesses are distinctive and are subject to acceptance and evaluation. The necessary FICO rating might be greater dependant on your relationship with American Express, credit rating background, along with other aspects.

At the time you decide which kind of loan you would like, your lender will ask for selected paperwork and financial documents to determine Should your business qualifies. These documents may incorporate:

You should keep your individual credit score score approximately snuff, as the newer your business as well as smaller your revenues, the greater lenders will analyze your personal finances.

Gear loans are granted specifically for the purchase of latest devices, using what you buy as collateral.

The Small Business Administration sets regulations and rules that lenders need to comply with when issuing SBA loans. To qualify for an SBA loan, a business have to be a for-profit business located in The us or its territories. The business owner need to have invested their own money and time within the business and need to have fatigued all other funding selections.

Together these lines, nevertheless, it’s critical you can succinctly condition how get more info you satisfy The task demands or a person of those general public policy targets, and back again up your assert with correct documentation.

At the start, so that you can qualify for your SBA 504 loan system, you’ll really have to display that you intend to make use of the financing for an suitable reason. As we stated briefly over, on The entire, SBA 504 loans are made for the acquisition of big mounted property.

Examine lenders. Take into consideration elements like how speedily they disburse cash, the lender’s reputation, and no matter if you prefer to apply in person or on the internet.

Specifications differ by lender, but corporations frequently qualify for business loans dependant on dimension, income, private and business credit history profiles, and just how long they’ve been running. They obtain funding as lump sums or credit traces, with regards to the sort of loan and lender.

On this web page, you’ll discover a list of a lot of the optimum-rated lenders inside the business. Consider their assessments, Review their characteristics, and locate the lender that’s finest suited to meet the desires within your business.

Corporation listings on this web site Don't suggest endorsement. We do not function all vendors available. Other than as expressly set forth in our Terms of Use, all representations and warranties regarding the data presented on this page are disclaimed. The knowledge, such as pricing, which seems on This great site is matter to vary Anytime

With adaptable technologies finance alternatives, we deal with every phase of a company’s expansion—from startup funding to IPO to exit—that will help entrepreneurs deliver their innovation to market place.

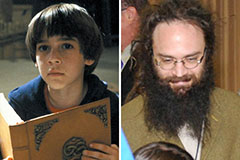

Barret Oliver Then & Now!

Barret Oliver Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!